Looking Back at June

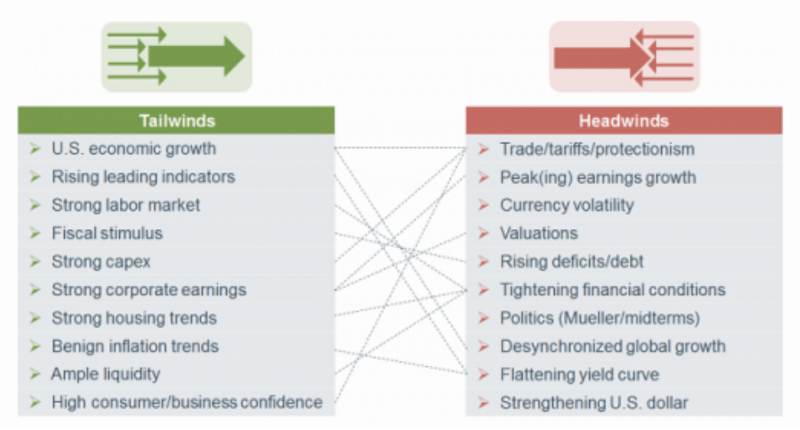

The U.S. economic data for June 2018 was very strong. While it should indicate a strong upward market movement, trade and tariff policies currently in play have slowed the rise of the market. Investors are caught between a strong economy and uncertain trade policies. As new policies were addressed, the market seemed to react less and less – which may not always be the case. If a major trade policy is put in place by either the US or a foreign government (toward the US), it could result in major volatility.

Employment is very strong. This month there were more positions available than workers to fill them. One problem is the lack of skilled workers for particular jobs. This could add to (wage) inflation along with the Fed’s gradual raise of interest rates which could add to an overall inflationary trend.

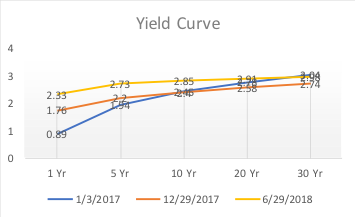

The flattening Yield curve is beginning to concern analysts. As noted in the chart, the yellow line (more recent) is much flatter than the blue line (January 1, 2017). Analysts are concerned that this could indicate problems as the economy grows.

Looking Ahead to July

The tightness in the labor market, along with strong economic growth and uncertain trade policies will probably cause market volatility to continue. Volatility is normal, but not always well-liked. The overall trend is for the market to continue upward, although not steady until trade policies are settled.

Our View

Our view has not changed from last month. The summer is typically when many investors let their investments sit, so action in the market is often more volatile because fewer investors are participating. As investors, not traders, we need to look past the summer and into the fall. We still believe that our allocations should tilt away from bonds. We will continue to closely monitor economy developments as well as global events that affect the market.